The effect time lag of fiscal policy refers to

A. the difficulty in getting the President and the Congress to agree on an appropriate policy.

B. the time between the onset of a policy and when the policy has impact on the economy.

C. the time needed for Congress to enact a policy.

D. the delay in recognizing an economic problem.

Answer: B

You might also like to view...

Assume that the government increases spending and finances the expenditures by borrowing in the domestic capital markets. If the nation has highly mobile international capital markets and a flexible exchange rate system, what happens to the quantity of real loanable funds per time period and the nominal value of the domestic currency in the context of the Three-Sector-Model?

a. There is not enough information to determine what happens to these two macroeconomic variables. b. The GDP Price Index rises, and nominal value of the domestic currency falls. c. The GDP Price Index rises, and nominal value of the domestic currency rises. d. The GDP Price Index falls, and nominal value of the domestic currency rises. e. The GDP Price Index rises, and nominal value of the domestic currency remains the same.

If the demand for dollars in the market for foreign-currency exchange shifts right, then the exchange rate

a. rises and the quantity of dollars exchanged rises. b. rises and the quantity of dollars exchanged does not change. c. falls and the quantity of dollars exchanged falls. d. falls and the quantity of dollars exchanged does not change.

Macroeconomics is concerned primarily with

A) large firms or multinational corporations. B) production and prices in particular markets. C) aggregate economic variables. D) normative issues.

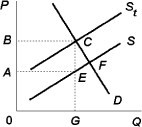

Using the above figure, if the government levies a new unit tax in this market, S represents the original supply curve, and St represents the after-tax supply curve, then the revenues that the government collects from imposing this tax is represented on this graph by

Using the above figure, if the government levies a new unit tax in this market, S represents the original supply curve, and St represents the after-tax supply curve, then the revenues that the government collects from imposing this tax is represented on this graph by

A. BAEC. B. OAEG. C. CEF. D. OBCG.