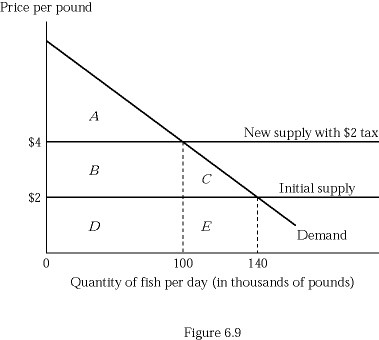

Figure 6.9 depicts a hypothetical fish market with a horizontal supply curve. Suppose the government imposes a tax of $2 per pound of fish, and the tax is paid in legal terms by producers. Which of the following statements is correct?

Figure 6.9 depicts a hypothetical fish market with a horizontal supply curve. Suppose the government imposes a tax of $2 per pound of fish, and the tax is paid in legal terms by producers. Which of the following statements is correct?

A. Producers bear the full cost of the tax.

B. Consumers bear the full cost of the tax.

C. Both producers and consumers equally share the tax.

D. Consumers bear a relatively large share of the tax, compared to producers.

Answer: B

You might also like to view...

The darkened area in the figure above is the

A) deadweight loss. B) firm's economic loss. C) consumer surplus. D) firm's total cost. E) firm's total revenue.

Everything else held constant, if a central bank makes an unsterilized ________ of foreign assets, then the domestic money supply will increase and the domestic currency will ________

A) purchase; appreciate B) purchase; depreciate C) sale; appreciate D) sale; depreciate

A ban on imports, a tariff, or a quota raise the price to domestic consumers. This means that consumers will buy less of the product at a higher price. The loss associated with this is called

A) production associated loss. B) barrier associated loss. C) deadweight loss. D) trade loss.

Workers in high-wage countries cannot improve their real income when they trade with low-wage countries

a. True b. False Indicate whether the statement is true or false