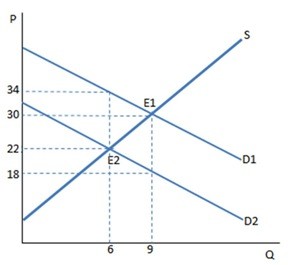

The graph shown demonstrates a tax on buyers. Who bears the greater tax incidence?

The graph shown demonstrates a tax on buyers. Who bears the greater tax incidence?

A. The buyer

B. The government

C. The seller

D. The incidence is equally shared between buyer and seller

Answer: C

You might also like to view...

A sudden massive reduction in the availability of chocolate will likely cause the price of chocolate to ________, which will ________ the quantity of chocolate demanded by consumers

A) increase; increase B) increase; decrease C) decrease; increase D) decrease; decrease

The slope of the line in the above figure is

A) 8. B) 0.05. C) 0.125. D) 0.10.

The reason that the Fisherman's Friend restaurant in Stonington, Maine had a monopoly on selling seafood dinners in that town is most likely due to

A) no competitors apparently found the profit level attractive enough to enter the market. B) the restaurant owned all the fresh seafood in the state. C) a government-imposed barrier. D) occupational licensing.

U.S. securities firms recently agreed to pay a record amount of $1.4 billion in settlement charges brought by government regulators. Regulators claimed that firms had abused investors during the market boom of the 1990s

Abuses included analysts tailoring their research reports and ratings on the stocks they covered in order to win more business for their firm. If this settlement causes Wall Street firms to comply with the letter of the law but they violate the spirit of the law, the firms are engaging in A) elimination of conflicts of interest. B) creative response. C) the capture hypothesis. D) deregulation.