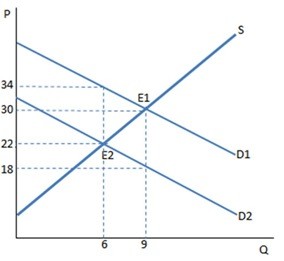

Does a tax on buyers affect the supply curve?

Does a tax on buyers affect the supply curve?

A. Yes, it shifts to the right by the amount of the tax.

B. Yes, it shifts to the left by the amount of the tax.

C. Yes, it shifts up by the amount of the tax.

D. No, there is change in the quantity supplied, but the supply curve does not move.

Answer: D

You might also like to view...

For a public good, the marginal social benefit curve is the ________ summation of all the individual marginal benefit curves

For a private good, the marginal social benefit curve is the ________ summation of all the individual marginal benefit curves. A) horizontal; vertical B) vertical; horizontal C) vertical; vertical D) horizontal; horizontal

If both matches and automobile prices increase by 10 percent, consumers will likely buy

A. fewer matches and approximately the same quantity of automobiles. B. approximately the same quantity of matches and fewer automobiles. C. fewer matches and fewer automobiles. D. approximately the same quantity of both matches and automobiles.

Refer to the payoff matrix below. Which of the following is the Nash Equilibrium?

A) Set Low Price/Set Low Price

B) Set High Price/Set Low Price

C) Set High Price/Set High Price

D) Set Low Price/Set High Price

An increase in the money supply:

a. raises the interest rate, causing an increase in investment and an increase in GDP. b. lowers the interest rate, causing an increase in investment and an increase in GDP. c. raises the interest rate, causing a decrease in investment and an increase in GDP. d. lowers the interest rate, causing a decrease in investment and an increase in GDP. e. lowers the interest rate, causing a decrease in investment and a decrease in GDP.