In a large open economy,

A) domestic lending and borrowing decisions have no impact on the world real interest rate.

B) an increase in the domestic supply of loanable funds would lower the world real interest rate.

C) the domestic equilibrium real interest rate is determined independently of foreign borrowing and lending.

D) an increase in the domestic demand for loanable funds would lower the world real interest rate.

B

You might also like to view...

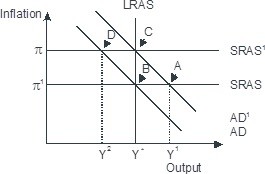

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

If an economy experiences a $0.8 trillion increase in investment resulting in an increase in real GDP from $10 trillion to $12 trillion,

a. what is the change in equilibrium expenditure? b. what is the change in autonomous expenditure? c. what is the multiplier? d. how would an increase in the marginal tax rate effect the multiplier?

If the substitution effect from a higher wage rate exceeds the income effect, then a higher wage rate

A) increases the quantity of labor supplied. B) decreases the quantity of labor supplied. C) shifts the supply of labor curve leftward. D) shifts the supply of labor curve rightward.

If the price elasticity of demand is 1.5, regardless of which two points on the demand curve are used to compute the elasticity, then demand is

a. perfectly inelastic, and the demand curve is vertical. b. elastic, and the demand curve is a straight, downward-sloping line. c. perfectly elastic, and the demand curve is horizontal. d. elastic, and the demand curve is something other than a straight, downward-sloping line.