Income taxes are an automatic stabilizer because when income falls, ceteris paribus, tax receipts

A. Fall as taxpayers experience bracket creep.

B. Rise because automatic stabilizers work against the cyclical movements of the GDP.

C. Fall because income taxes are regressive.

D. Fall because taxes are computed on the basis of income.

Answer: D

You might also like to view...

Suppose the average price of gasoline in the United States rose from $3 per gallon to $4 per gallon. Accompanying the increase in gas prices was a decrease in new automobile sales

Other things equal, if this trend continues, real GDP would likely ________ and the output gap would become ________. A) rise; more negative B) rise; less negative C) fall; more negative D) fall; less negative

Recall the text's discussion of the ten largest U.S. industries by value added in 1860 and 1910 . The emergence of tobacco products and malt liquors as major industries by 1910 suggests that

a. these goods are highly income elastic. b. these goods are highly income inelastic. c. these goods are price inelastic. d. these goods exhibit economies of scale in production.

A firm's opportunity cost of using resources provided by the firm's owners is called

a. sunk costs b. fixed costs c. explicit costs d. implicit costs e. entrepreneurial costs

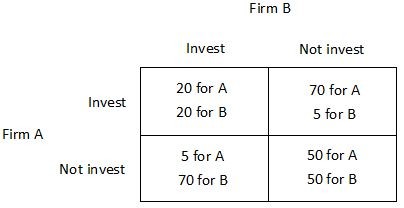

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital. Firm A's dominant strategy is to ________, and Firm B's dominant strategy is to ________.

Firm A's dominant strategy is to ________, and Firm B's dominant strategy is to ________.

A. not invest; not invest B. not invest; invest C. invest; invest D. invest; not invest