The _________________________ command can be used to replace bulleted text with a SmartArt graphic

Fill in the blank(s) with correct word

Convert to SmartArt

You might also like to view...

The study conducted by Chongxin Yu and Stephen J. Frenkel of the University of New South Wales suggested that managers should engage in supportive behaviors that encourage employees to feel connected to their peers and to anticipate the possibility of a successful career path in the organization in order to ______.

A. inspire more social behaviors in the workplace B. facilitate more top-down leadership in the workplace C. foster less autocratic leadership in the workplace D. facilitate more creativity in the workplace

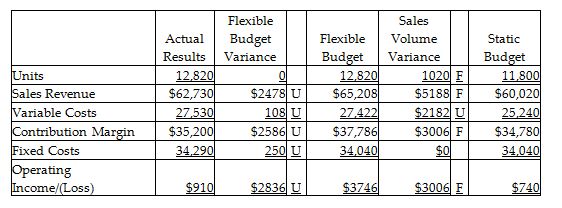

The Alaska Fish Company completed the flexible budget analysis for the second quarter, which is given below.

Which of the following statements would be a correct factor to explain the sales volume variance for operating income?

A) decrease in sales price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Involvement refers to

A. the time, energy, and personal investment that will be required to use a product. B. the external influences that affect a consumer's purchase. C. the total number of people involved in the actual exchange process. D. the personal, social, and economic significance of the purchase to the consumer. E. the level of difficulty involved in making a purchase.

Which one of the following would NOT result in incremental cash flows and thus should NOT be included in the capital budgeting analysis for a new product?

A. Revenues from an existing product would be lost as a result of customers switching to the new product. B. Shipping and installation costs associated with a machine that would be used to produce the new product. C. The cost of a study relating to the market for the new product that was completed last year. The results of this research were positive, and they led to the tentative decision to go ahead with the new product. The cost of the research was incurred and expensed for tax purposes last year. D. It is learned that land the company owns and would use for the new project, if it is accepted, could be sold to another firm. E. Using some of the firm's high-quality factory floor space that is currently unused to produce the proposed new product. This space could be used for other products if it is not used for the project under consideration.