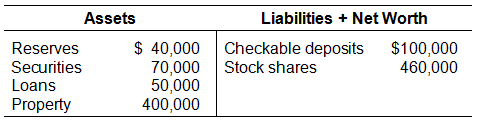

If the balance sheet below were for the entire banking system instead of just a single bank, by how much could loans be expanded? Assume a reserve ratio of 20%.

The system as a whole could support up to $100,000 in new loans. If there were no leakages, the $20,000 in excess reserves would be in the system as if the system were one gigantic bank. As long as those reserves are in the system they must equal 20% of new loans. $20,000 is 20% of $100,000. Therefore, $100,000 worth of new loans can be created in the system with $20,000 of excess reserves. (The monetary multiplier is 1/.20 or 5; 5 times $20,000 = $100,000.) Check able deposits would then become $200,000 and actual reserves of $40,000 would just meet the legal requirement.

You might also like to view...

What are the advantages of setting up a proprietorship or partnership as opposed to a corporation?

What will be an ideal response?

In 2013, interest payments were about ____ percent of national income

a. 0.51/2 b. 1.29 c. 3.2 d. 4.0

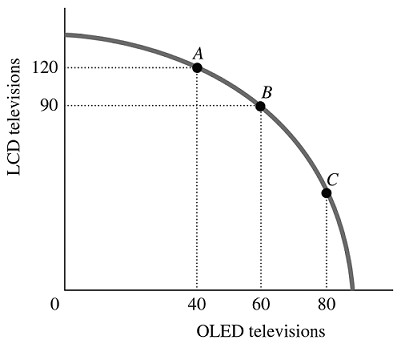

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point A to Point B is

Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point A to Point B is

A. -2/3. B. -1.5. C. -3. D. -30.

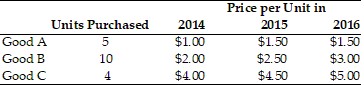

Refer to the information provided in Table 22.6 below to answer the question(s) that follow.

Table 22.6 Refer to Table 22.6. The bundle price for the goods in period 2014 is

Refer to Table 22.6. The bundle price for the goods in period 2014 is

A. $41.00. B. $50.50. C. $57.50. D. $100.00.