How do expectations of higher inflation become embedded in the economy and affect actual inflation?

What will be an ideal response?

Workers will push for an increase in their nominal wages while investors will demand a higher nominal interest rate. As workers, firms, and investors adjust from expecting a low inflation rate to expecting a higher inflation rate, at any given unemployment rate, the inflation rate will be higher.

You might also like to view...

The substitution effect can be defined as:

A. the change in consumption that results from a change in the relative price of goods. B. the change in consumption that results from increased effective wealth due to lower prices. C. the change in consumption that results from increased effective wealth due to getting a raise. D. the change in income that results from increased effective consumption due to lower prices

Per capita GDP will definitely fall if

A. The rate of economic growth is less than the rate of population growth. B. There is a decrease in the size of the working population. C. The population falls. D. The rate of economic growth falls.

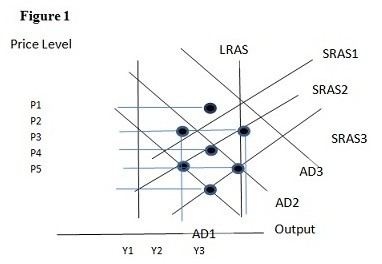

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the long run would be:

A. P1 and Y2. B. P2 and Y2. C. P3 and Y1. D. P2 and Y3.

Explain why when the demand curve for a good is elastic, a one percent reduction in the price of the good will increase a consumer's expenditure on the good

What will be an ideal response?