Consider a zero-coupon bond with a $1,100 payment in one year. Suppose the interest rate decreases from 10% to 8%. The price of this bond:

A. increases from $1,000 to $1,375.

B. increases from $1,000 to $1,018.

C. decreases from $110 to $88.

D. decreases from $1,210 to $1,188.

Answer: B

You might also like to view...

Oligopolistic firms tend to make large economic profits over time because

A. they have complete control in the market to charge any price they want. B. they produce at a point that is allocatively efficient. C. they charge higher than average total cost prices. D. they are productively efficient and produce the least costly way.

The primary effect of OPEC actions in the period from 1973 to 1980 was to increase

a. wage rates. b. interest rates. c. employment and output. d. energy prices.

Profits in the short run attract resources to industries in the long run, allowing them to expand.

Answer the following statement true (T) or false (F)

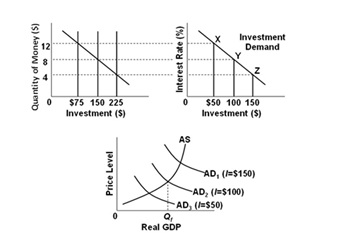

Refer to the graphs, in which the numbers in parentheses near the AD1, AD2, and AD3 labels indicate the level of investment spending associated with each curve. All figures are in billions. The economy is at point Y on the investment demand curve. Given these conditions, what policy should the Fed pursue to achieve a noninflationary full-employment level of real GDP?

A. Increase aggregate demand from AD3 to AD2

B. Decrease the money supply from $225 to $150 billion

C. Increase interest rates from 4 to 8 percent

D. Make no change in monetary policy