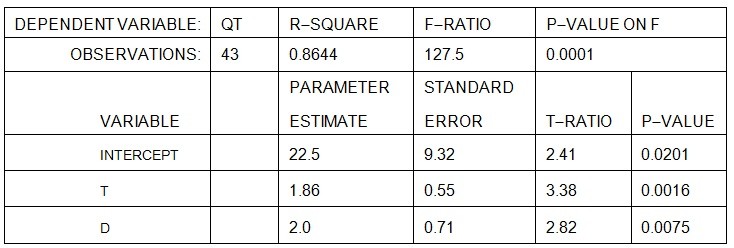

A consulting firm estimates the following quarterly sales forecasting model:Qt = a + bt +cDThe equation is estimated using quarterly data from 2005 I - 2015 III (t = 1,..., 43). The variable D is a dummy variable for the second quarter where: D = 1 in the second quarter, and 0 otherwise. The results of the estimation are:  Using the estimated trend line above, what is the predicted level of sales in 2015 IV ?

Using the estimated trend line above, what is the predicted level of sales in 2015 IV ?

A. 104.34

B. 106.20

C. 102.2

D. 110.06

E. none of the above

Answer: A

You might also like to view...

Total taxes minus transfer payments minus government interest payments is called:

A. a budget surplus. B. a budget deficit. C. national saving. D. net taxes.

How do current tax laws in the United States favor employer-based health care insurance?

A) Individuals who receive health insurance benefits are allowed to deduct the value of these benefits from their taxable income. B) Individuals who receive health insurance benefits do not pay taxes on the value of these benefits. C) Employers who provide health insurance benefits are reimbursed by the government and are not taxed on these reimbursements. D) Health insurance companies that provide insurance to employers are subject to a lower tax rate than those insurance companies that provide insurance to private individuals.

From the net tax function: T = t0 + t1Y, where t0 < 0 and t1 > 0, it follows that, as income rises

a. average taxes falls and the surplus declines. b. average taxes rises and the deficit increases. c. average taxes falls and the deficit declines. d. Average taxes and the deficit do not change.

Under perfect competition, the supply curve is

A. the marginal cost curve, but only the portion that is downward sloping. B. the marginal cost curve for all price quantity combinations. C. the marginal cost curve, but only the portion that is upward sloping. D. the marginal cost curve, but only the portion that is above the minimum of average variable cost.