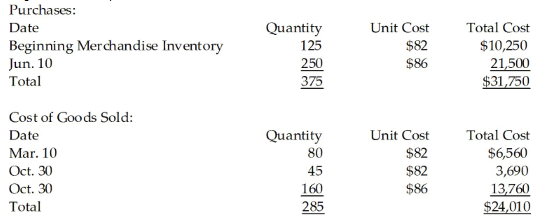

What would be reported as Cost of Goods Sold on the income statement for the year ending December 31, 2019 if the perpetual inventory system and the first-in, first-out inventory costing method are used?

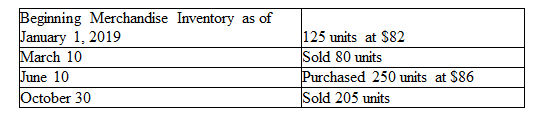

Baldwin Company had the following balances and transactions during 2019:

A) $10,250

B) $17,450

C) $31,750

D) $24,010

D) $24,010

You might also like to view...

An inventory record contains part number, part name, part color, and part weight. These individual items are called

a. fields. b. stored files. c. bytes. d. occurrences.

Streif Inc., a local retailer, has provided the following data for the month of June: Merchandise inventory, beginning balance$46,000Merchandise inventory, ending balance$52,000Sales$260,000Purchases of merchandise inventory$128,000Selling expense$13,000Administrative expense$40,000 The net operating income for June was:

A. $132,000 B. $85,000 C. $126,000 D. $79,000

Neef Corporation has provided the following data for its two most recent years of operation: Selling price per unit$84Manufacturing costs: Variable manufacturing cost per unit produced: Direct materials$12Direct labor$5Variable manufacturing overhead$4Fixed manufacturing overhead per year$432,000 Selling and administrative expenses: Variable selling and administrative expense per unit sold$5Fixed selling and administrative expense per year$61,000 Year 1 Year 2Units in beginning inventory0 3,000Units produced12,000 9,000Units sold9,000 10,000Units in ending inventory3,000 2,0000 The net operating income (loss) under absorption costing in Year 2 is closest to:

A. $186,000 B. $136,000 C. $87,000 D. $75,000

Which of the following statements about financial assumptions is not true?

a. They explain how the numbers are derived. b. They should be clear and precise. c. They are the most integral part of the financial segment. d. They do not necessarily correlate with information from other parts of the business.