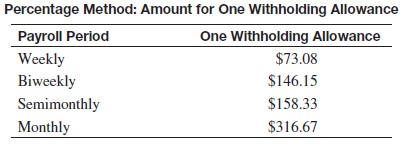

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and 1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over $115,000 so far this year.

Fred Jones has gross earnings of $4723.08 biweekly. He is married and has 3 withholding allowances.

Fred Jones has gross earnings of $4723.08 biweekly. He is married and has 3 withholding allowances.

A. $4,035.27

B. $4,361.77

C. $3,673.96

D. $5,049.58

Answer: C

Mathematics

You might also like to view...

Solve the equation. Express radicals in simplest form.-2k2 - 1 = -19

A. ±6 B. -9.5 C. 3 D. ±3

Mathematics

Solve the problem.A bicycle with a 26-inch wheel (diameter) travels a distance of 300 feet. How many revolutions does the wheel make (to the nearest revolution)?

A. 44 revolutions B. 38 revolutions C. 82 revolutions D. 88 revolutions

Mathematics

Decide whether the pair of functions graphed are inverses.

A. Yes B. No

Mathematics

Write the system as a matrix equation of the form AX = B. 6x1 + 4x2 = 30 8x2 = 72

A.

=

=

B.

=

=

C.

=

=

D.

=

=

Mathematics