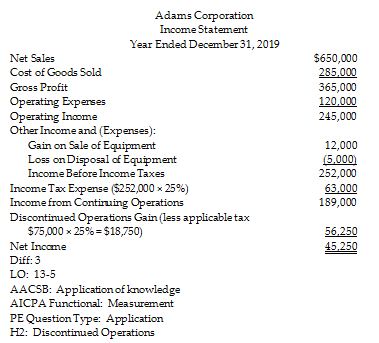

Adams Corporation's accounting records include the following items for the year ending December 31, 2019:

The income tax rate for the company is 25%. Prepare Adams' multi-step income statement for the year ended December 31, 2019. Omit earnings per share.

You might also like to view...

A new task purchase situation exists when a new, potential vendor offers a company what is perceived to be a better buy than the company is getting now from the current vendor, and members of the buying center want to reconsider the purchase decision

Indicate whether the statement is true or false

Which of these sciences is not linked to organizational behavior?

A. social psychology B. accounting C. political science D. anthropology

Compute the June 20xx cost of capital (rounded to nearest percent) for an investment center with the following information: Pre-tax operating income for June 20xx $17,500,000 Assets at June 30, 20xx 6,200,000 Current liabilities at June 30, 20xx 4,000,000 Long-term liabilities at June 30, 20xx 1,500,000 Income tax expense for June 30, 20xx 5,000,000 EVA 11,940,000

a. 10 percent b. 25 percent c. 13 percent d. 17 percent

When a court reviews an agency's application of a statute that it administers, if

Congress has not specifically addressed the question at issue, the court may use its own interpretation of the statute's application to decide the issue. a. True b. False