In the new classical model, a $100 billion increase in government purchases financed by borrowing will

a. increase the real interest rate, which will crowd out private spending.

b. lead to a $100 billion increase in real GDP.

c. lead to a $400 billion increase in real GDP if the marginal propensity to consume is three-fourths.

d. leave the interest rate, aggregate demand, and real output unchanged.

D

You might also like to view...

Going to the dentist would be counted in GDP as:

A. crowns and fillings. B. insurance utilization. C. a service. D. a measure of welfare.

The local department store might have been considered ________ before technological change.

A. a perfect competitor B. a natural monopoly C. an oligopoly D. a monopoly

The rate of interest that you pay on a home loan depends upon all of the following EXCEPT

A) the supply of houses in the real estate market. B) the length of the loan. C) your credit rating. D) handling charges or loan fees.

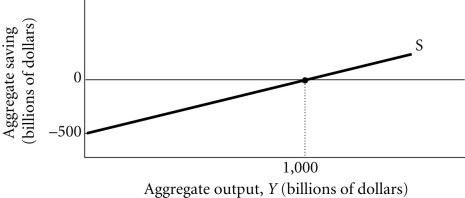

Refer to the information provided in Figure 23.1 below to answer the question(s) that follow. Figure 23.1Refer to Figure 23.1. [-500 + 0.5Y] is this household's

Figure 23.1Refer to Figure 23.1. [-500 + 0.5Y] is this household's

A. consumption. B. saving. C. MPC. D. MPS.