Assume that the world price of Good A is $8 per unit while its domestic price is $6, and the marginal cost incurred by domestic producers for producing one unit of Good A is $5 . If the government imposes a tax of $3 per unit on domestic producers, which of the following situations will be observed?

a. The tax will increase the price of Good A in the domestic market.

b. The tax will increase the world price of Good A.

c. The tax will decrease the profit earned by domestic producers.

d. The tax will decrease the price of Good A in the domestic market.

C

You might also like to view...

"Because the price of a diamond is much greater than the price of a gallon of water, the consumer surplus from diamonds is greater than the consumer surplus from water." Is the previous analysis CORRECT? Explain your answer

What will be an ideal response?

Growth in total factor productivity equals the _____

a. sum of resource growth and economic growth b. ratio of total output to total input c. ratio of total input to total output d. percentage change in per capita real GDP e. percentage change in output minus the percentage change in resources

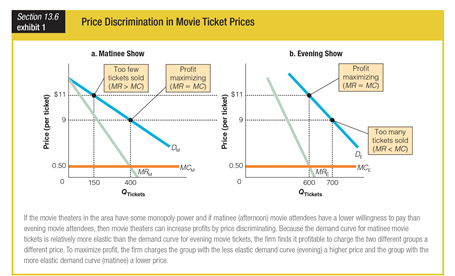

Based on the graphs showing price discrimination in movie ticket prices, if the theatre charges $11 per ticket at the evening show, it will ______.

a. maximize profits

b. sell too many tickets

c. sell too few tickets

d. sell no tickets

Gold would be a superior commodity money compared to wheat because:

A. it is easier to divide wheat into small units. B. wheat has more practical uses than gold. C. wheat is perishable. D. wheat has a high value relative to weight, which gold does not.