Suppose a particular production process results in a large amount of pollution and the government decides to impose a tax to correct for this externality, such that the socially optimal output will be produced. The tax will have the effect of shifting the

A. marginal private benefit curve to the right.

B. marginal social benefit curve to the right.

C. marginal private cost curve to the left.

D. marginal social cost curve to the left.

E. marginal private cost curve to the right.

Answer: C

You might also like to view...

If you hear an economist argue that the economy does not experience business cycles but merely experiences variations in economic activity over time, you know that economist belongs to the school of

a. real business cycle theory b. Keynesian economics c. production possibilities growth theory d. accelerator cycle theory e. capital-based, long run growth theory

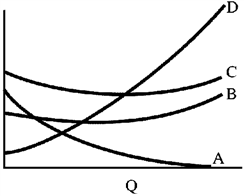

Figure 7-10

In Figure 7-10, the curve labeled C is

a.

average fixed cost.

b.

average total cost.

c.

average variable cost.

d.

marginal cost.

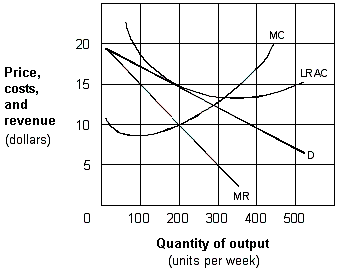

Exhibit 10-2 A monopolistic competitive firm

A. zero. B. $200 per week. C. $1,000 per week. D. $20,000 per week.

According to the law of demand, a decrease in the price of a good causes

A. an upward movement along the demand curve for that good. B. a rightward shift of the demand curve for that good. C. a downward movement along the demand curve for that good. D. a leftward shift of the demand curve for that good.