Refer to Scenario 19.1 below to answer the question(s) that follow. SCENARIO 19.1: An individual earning $60,000 pays $12,000 in taxes. The marginal tax rate on any income earned above $60,000 is 25%. Refer to Scenario 19.1. Suppose this person earns $70,000 and gives a $1,000 tax deductible donation to charity. The donation reduces her tax payment by

A. $200.

B. $207.

C. $250.

D. $1000.

Answer: C

You might also like to view...

Government assistance to the poor in the United States

A. has eliminated poverty in the nation. B. is available to all persons whose income is below the poverty income threshold. C. is available in most cases only to the poor who are elderly, disabled, or families with children. D. is always in the form of cash.

For a price-taking firm, marginal revenue

A. is the addition to total revenue from producing one more unit of output. B. decreases as the firm produces more output. C. is equal to price at any level of output. D. both a and b E. both a and c

Which statement is true?

A. The Federal Reserve has an excellent record as a "lender of last resort." B. There is little debate about whether or not the Federal Reserve Board should be independent. C. The power of the Federal Reserve is centered largely in its Board of Governors. D. The stockholders in the Federal Reserve receive large profits.

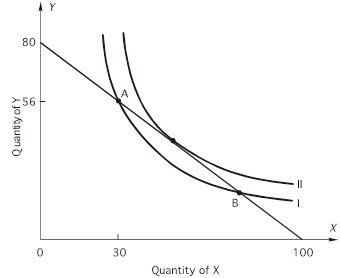

The consumer's income is $800.According to the above figure, what is the consumer's marginal rate of substitution in equilibrium?

The consumer's income is $800.According to the above figure, what is the consumer's marginal rate of substitution in equilibrium?

A. 2.5 B. 1.5 C. 2 D. 0.8 E. unable to tell from information given