A tax cut is likely to cause:

A. An increase in consumer spending.

B. A decrease in saving.

C. A decrease in aggregate demand.

D. An increase in government spending.

A. An increase in consumer spending.

You might also like to view...

In September 2006, the Food and Drug Administration recommended that Americans avoid eating bagged raw spinach in the wake of an outbreak of E. coli bacteria

Following this recommendation, the food industry looked at alternatives and many turned to arugula. One Chicago distributor claimed, "The sale of the stuff has gone through the roof." Based on this information A) the cross-price elasticity between arugula and spinach is negative. B) the cross-price elasticity between arugula and spinach is positive. C) the price elasticity of arugula is positive while the price elasticity of spinach falls to zero. D) arugula is a normal good while raw spinach is an inferior good.

The difference between consumption spending and disposable income _____

a. decreases as income increases b. stays proportionally the same as income increases c. decreases if the interest rate increases d. equals the amount of taxes paid e. equals saving

Instead of a uniform standard, suppose each firm faces a volume-based, marginal effluent fee (MEF) of $90. How much will each firm abate?

Among the identified point sources contributing to the pollution of Puget Sound are Dow Chemical (D) and Chevron (C). Each firm's cost functions are shown below. MACD = 2.5AD MACC = 3.75AC TACD = 1.25AD2 TACC = 1.875AC2 To meet the effluent limits under the Clean Water Act, each firm has an NPDES permit to release some fixed amount of effluents, so each must abate 30 units.

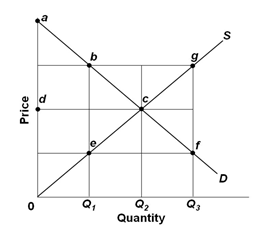

Refer to the graph below. If the output level is Q2, then there will be:

A. Allocative efficiency

B. Maximum deadweight losses

C. Maximum consumer surplus

D. Greater marginal benefits than marginal costs of the product