Consider a $30,000 car loan over six years at 7% APR. Assume an option where the car loan offers 0% financing for the first two years of the loan or 7% financing over six years. What are the payment choices to ensure that no interest on the loan is paid?

What will be an ideal response?

Answer: There are two methods to consider. First, you can make 24 equal payments of = $1,250. This will pay off the entire loan before interest is charged. Second, you can make the regular 7% APR payments for two years and then pay off the balance with what is called a balloon payment. The PVIFA factor for 6 × 12 = 72 periods and a periodic interest rate of = 0.58333% is:

PVIFA = 58.65444. The monthly annuity payment is: PMT = = = $511.47. The total monthly payments for two years would be 24 × $511.47 = $12,275.28. Therefore, your balloon payment at the end of two years would be $30,000.00 - $12,275.28 = $17,724.72.

You might also like to view...

Answer the following statements true (T) or false (F)

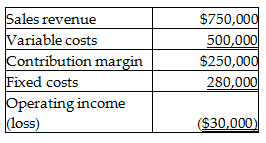

Victor Corporation has provided you with the following budgeted income statement for one of its products:

Victor Corporation believes that 65% of the fixed costs would be avoidable if the product line was dropped. Based on the impact on the company's operating income or loss, Victor should keep the product line.

Which of the following interests in real property transfers to another person after the present holder's death?

A) easement B) mortgage C) installment D) life estate

How do U.S. antitrust laws affect international business?

Viewmont Manufacturing began the year owing its suppliers $4,800 for merchandise purchased last year. Viewmont then sold half of this merchandise for $8,000 on account. Two weeks later, Viewmont paid its suppliers $1,600 and bought another $6,400 of merchandise on account. Viewmont now has an Accounts Payable balance of:

A. $9,600. B. $1,600. C. $17,600. D. $7,200.