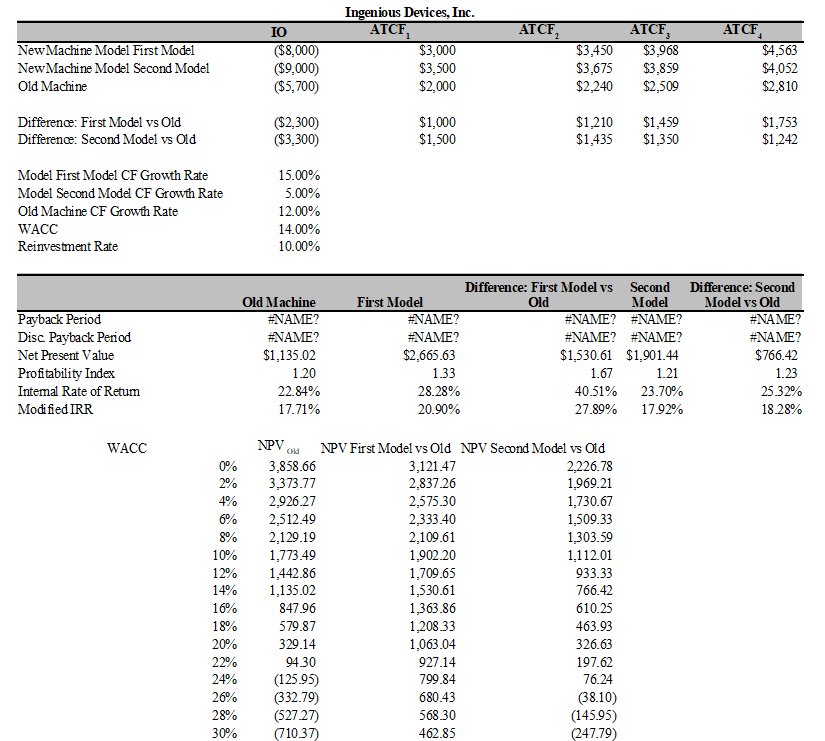

Ingenious Devices, Inc. is considering a replacement for its damaged old cutting machine with a new laser cutting machine. Repairing this machine would cost $5,700. Management has requested information about two new machines from two different vendors. The old machine has no salvage value. The estimated after-tax cash flow associated with the old machine for the next year is $2,000 and the firm expects that this cash flow will grow at a rate of 12% per year over the next four years.

The first model of the new laser cutting machine has a price of $8,000 and the firm expects to generate after-tax cash flows of $3,000 with this machine for the next four years. These cash flows will grow at an annual rate of 15% over the next four years. Finally, the second model of the new laser cutting machine has a selling price of $9,000 and the firm expects to produce after-tax cash flows of $3,500 for the next year. This cash flow will grow at a rate of 5% per year over the next four years. If the firm’s WACC is 14% and its reinvestment rate is 10%, determine the following:

a) Calculate the payback period, discounted payback period, NPV, PI, IRR, and MIRR of the existing machine. If no option were available to replace this old machine, would it make sense to repair it?

b) Considering each new model as a replacement project, which model should the firm choose? Determine the payback period, discounted payback period, NPV, PI, IRR, and MIRR of each new model versus the old machine using the incremental initial costs and annual after-tax cash flows to answer this question.

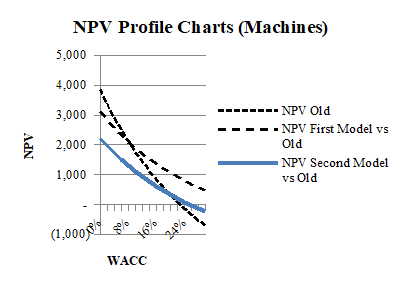

c) Create an NPV profile chart for the old machine and for the replacement of the old machine with the new models.

You might also like to view...

Jing-Ying places great value on the posture, voice inflection, gestures, and facial expressions of employees within the workplace. She is most likely part of a(n) ____ culture

A) low-context B) linear logic C) high-context D) analytical

Can an investment project of a foreign subsidiary that has a positive net present value when evaluated as a stand-alone firm ever be rejected by the parent corporation? Assume that the parent accepts all projects with positive adjusted net present values

What will be an ideal response?

What is ex parte communication and why is it not allowed?

What will be an ideal response?

Historical comparisons will reveal whether a company's performance is improving or deteriorating

Indicate whether the statement is true or false.