If the federal budget is initially balanced and government expenditures remain constant, then an increase in GDP will _________ tax revenues and create a budget _________.

A) increase tax revenues and create a budget surplus.

B) increase tax revenues and create a budget deficit.

C) decrease tax revenues and create a budget surplus.

D) decrease tax revenues and create a budget deficit.

Ans: A) increase tax revenues and create a budget surplus.

You might also like to view...

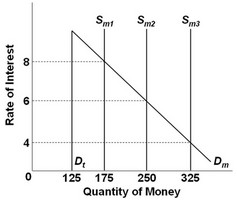

Use the following graph to answer the next question. In the graph, Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money. The market is in equilibrium at the 6% rate of interest. If the money supply then decreases as shown, the transaction demand for money will change by

In the graph, Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money. The market is in equilibrium at the 6% rate of interest. If the money supply then decreases as shown, the transaction demand for money will change by

A. $0. B. $75. C. $175. D. $125.

Refer to the scenario above. If the government removes the ban on Firm B and both Firm A and firm B aim at maximizing profits:

A) marginal cost of Firm A will eventually be greater than the marginal cost of Firm B. B) marginal cost of Firm B will eventually be greater than the marginal cost of Firm A. C) marginal cost of both firms will eventually be equalized. D) the difference in the marginal cost of both firms will eventually increase.

The decline in the value of the dollar from 1985 to 1988 was beneficial to

A. American tourists travelling to Europe. B. firms importing goods into America. C. American exporting businesses. D. foreigners holding U.S. government bonds.

If pretzels are a normal good, the income effect of a price change means that

a. as income increases, the quantity demanded increases along the demand curve for pretzels b. as income increases, the demand curve for pretzels shifts rightward c. as income increases, the demand curve for pretzels shifts leftward d. as the price of pretzels increases, the real income of individuals who demand pretzels decreases, so the quantity demanded of pretzels decreases e. as the price of pretzels increases, income increases