Explain why a comparison between the interest rates on domestic and foreign bonds might provide misleading information about which bonds yield the highest expected returns

What will be an ideal response?

A simple comparison of interest rates will ignore the expected exchange gains/losses that can occur from holding assets denominated in a foreign currency. Hence, such a comparison will likely provide incorrect information about which bonds have a higher expected return.

You might also like to view...

Fixed-money assets, like stocks and bonds, are included in which of the following components of GDP?

A. Government spending B. Venture capital C. Consumer spending D. They are not included in GDP measurement.

Raising the required reserve ratio __________ the simple deposit multiplier which will __________ the economy's money supply

A) raises; increase B) raises; decrease C) lowers; increase D) lowers; decrease

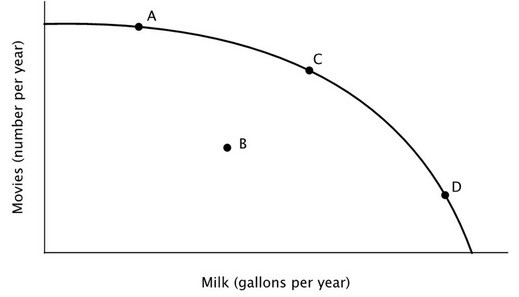

Refer to the accompanying figure. For the nation whose PPC is shown, it must be true that:

A. some of the nation's productive resources are better-suited to making milk, and some are better-suited to making movies. B. the nation has a comparative advantage in making milk. C. the nation's productive resources are better-suited to making milk than to making movies. D. the nation's productive resources are better-suited to making movies than to making milk.

Which of the following is characteristic of a pure monopolist's demand curve?

A. Average revenue is less than price. B. Its elasticity coefficient is 1 at all levels of output. C. Price and marginal revenue are equal at all levels of output. D. It is the same as the market demand curve.