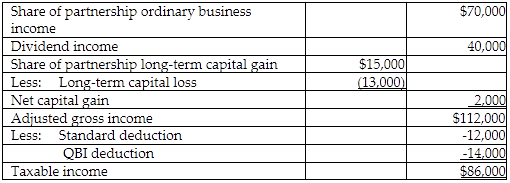

MN Partnership has two equal partners, Mark and Nadia. In the current year, the MN earns $140,000 of ordinary business income and a $30,000 long-term capital gain. Nadia is single. In addition to the partnership items, she reports $40,000 of dividend income and a long-term capital loss of $13,000 from her personal investment accounts. Nadia does not itemize her deductions. Calculate Nadia's 2018

taxable income.

What will be an ideal response?

Combined QBI is $14,000 ($70,000 × 20%). Excess taxable income without regard to the net capital gain is $98,000 ($70,000 + $40,000 - $12,000). The QBI deduction is the lesser of $14,000 or $19,600 ($98,000 × 20%).

You might also like to view...

In which of the following situations would the auditor modify the audit report on ICFR?

a. When the auditor relies on the work of other auditors but decides not to include a reference to the other auditors. b. When the auditor is unable to perform all procedures needed to evaluate the internal controls. c. When the auditor concludes that management's report on ICFR is not complete or is improperly presented. d. When the auditor identifies multiple unrelated significant deficiencies in ICFR.

The requirement that nonprofits achieve measurable results increased the need for ______.

A. empowered customers B. funding to state governments C. management D. voucher programs

Individuals who have an optimistic explanatory style tend to not view bad events in their lives as:

a. temporary b. pervasive c. specific d. impersonal

Flagstaff Company has budgeted production units of 7,900 for July and 8,100 for August. The direct materials requirement per unit is 2 ounces (oz.). The company has determined that it wants to have safety stock of direct materials on hand at the end of each month to complete 20% of the units of budgeted production in the following month. There was 3,160 ounces of direct material in inventory at the start of July. The total cost of direct materials purchases for the July direct materials budget, assuming the materials cost $1.15 per ounce, is:

A. $14,536. B. $18,170. C. $21,896. D. $18,262. E. $18,078.