The government budget constraint says that ________

A) the difference between spending and revenues must equal the amount of new bond issues

B) increases in spending must be matched by increases in revenue

C) interest on government debt must be paid before tax revenues are spent on goods and services or disbursed as transfer payments

D) state and local governments, in aggregate, cannot spend more than the federal government

A

You might also like to view...

Which one of the following states a central element of the economic way of thinking?

What will be an ideal response?

What kind of strike occurs when the members of a union local stop work without the consent of their national organization?

A. Sympathetic B. Limited C. Jurisdictional D. Wildcat

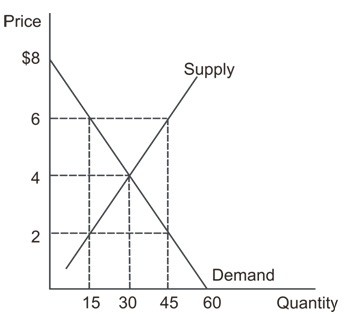

Refer to the graph shown that depicts a third-party payer market for prescription drugs. What happens to expenditures by consumers in this market if a $2 co-pay is established compared to a free-market equilibrium?

A. Expenditures rise by $90 B. Expenditures remain at $150 C. Expenditures fall by $120 D. Expenditures fall by $30

When current tax revenues exceed current government expenditures and the economy is achieving full employment:

A. the cyclically adjusted budget has neither a deficit nor a surplus. B. the cyclically adjusted budget may have either a deficit or a surplus. C. the cyclically adjusted budget has a surplus. D. the government is engaging in an expansionary fiscal policy.