According to the efficient markets hypothesis, worse-than-expected news about a corporation will

a. have no effect on its stock price.

b. raise the price of the stock.

c. lower the price of the stock.

d. change the price of the stock in a random direction.

c

You might also like to view...

Suppose you have a fixed-rate mortgage with a nominal interest rate of 6% and the expected annual inflation rate over the life of the mortgage is 2%. What is the expected real interest rate?

A) 3% B) 4% C) 8% D) 12%

The Chinese protected its automobile industry through restrictive tariffs and quotas. Which of the following BEST describes this practice?

a. antidumping duties b. infant industry protection c. voluntary export restraints d. price discrimination

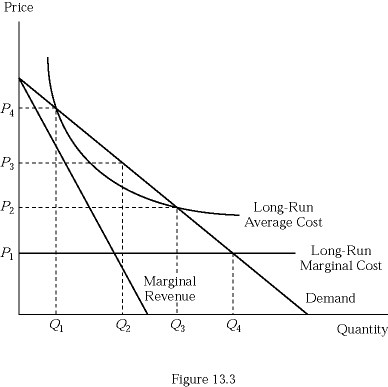

Consider the monopoly depicted in Figure 13.3. Relative to the cost of producing the quantity the monopolist would choose under an average-cost pricing policy, the cost of producing Q4 units is:

Consider the monopoly depicted in Figure 13.3. Relative to the cost of producing the quantity the monopolist would choose under an average-cost pricing policy, the cost of producing Q4 units is:

A. less. B. the same. C. more. D. twice as much.

A hedge is

A. an exchange rate arrangement in which a country pegs the value of its currency to the exchange value. B. a financial strategy that reduces the change of suffering losses arising from foreign exchange risk. C. active management of a floating exchange rate on the part of a country's government. D. the possibility that changes in the value of a nation's currency will result in variations in the market value of assets.