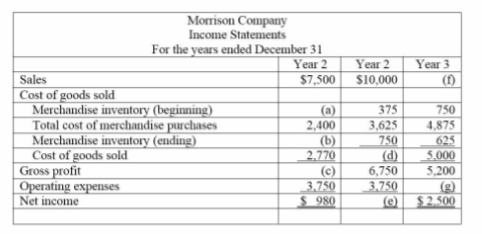

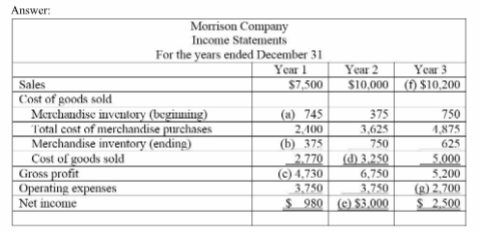

Fill in the blanks (a) through (g) for the Morrison Company for each of the income statements for years 1, 2, and 3.

(a) 2,770 + 375 — 2400 = 745

(b) 375, the beginning inventory for Year 2 is the ending inventory for Year 1

(c) 980 + 3,750 = 4,730

(d) 10,000 — 6,750 = 3,250

(e) 6,750 — 3,750 = 3,000

(f) 5,000 + 5,200 = 10,200

(g) 5,200 — 2,500 = 2,700

You might also like to view...

Retired shares of treasury stock may later be reissued

Indicate whether the statement is true or false

The only kind of utility created by production is time utility, because the producer makes that product available to the customer at the time it is needed.

Answer the following statement true (T) or false (F)

In 2005, seven of the country's largest unions left the AFL-CIO to form a new federation of unions called:

A. The Coalition for Employee Free Choice. B. The American Federation of Labor. C. Change to Win. D. The International Labor Organization.

For each of the following situations, select the best answer that applies to consolidating financial information subsequent to the acquisition date:(A) Initial value method.(B) Partial equity method.(C) Equity method.(D) Initial value method and partial equity method but not equity method.(E) Partial equity method and equity method but not initial value method.(F) Initial value method, partial equity method, and equity method.________ 1. Method(s) available to the parent for internal record-keeping.________ 2. Easiest internal record-keeping method to apply.________ 3. Income of the subsidiary is recorded by the parent when earned.________ 4. Designed to create a parallel between the parent's investment accounts and changes in the underlying equity of the acquired company.________ 5. For

years subsequent to acquisition, requires the *C entry.________ 6. Uses the cash basis for income recognition.________ 7. Investment account remains at initially recorded amount.________ 8. Dividends received by the parent from the subsidiary reduce the parent's investment account.________ 9. Often referred to in accounting as a single-line consolidation.________ 10. Increases the investment account for subsidiary earnings, but does not decrease the subsidiary account for equity adjustments such as amortizations. What will be an ideal response?