If you knew that an investment was going to pay you $1,188,757 in 20 years, and you knew that the annual interest rate over that time would be 2 percent, you could calculate the present value to be:

A. $1,000,000.

B. $1,500,000.

C. $905,000.

D. $800,000.

D. $800,000.

You might also like to view...

Suppose the local university charges $85 per credit hour. If tuition increases from $85 to $93 per credit hour, using the midpoint method, what is the percentage change in price?

A) 8.99 percent B) 8.00 percent C) 9.41 percent D) 8.62 percent E) 9.12 percent

According to the BEA, in the second quarter of 2012 personal consumption expenditures grew by 1.7 percent, gross private domestic investment grew by 3.0 percent,

government expenditure on goods and services decreased by -0.9 percent, imports grew by 2.9%, and exports grew by 6.0%. Given these data, it is most likely that A) GDP growth was positive in the 2nd quarter. B) GDP growth was negative in the 2nd quarter. C) the economy hit a business cycle peak. D) the economy hit a business cycle trough.

Looking ahead at how the customer is more likely to react, what price should the shopkeeper charge?

a. High price b. Low price c. Offer the good for free d. A compromised price between the high and the low price

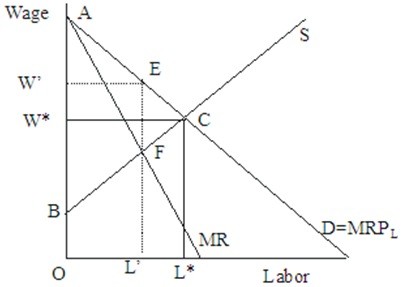

In Figure 45.4, when compared to the perfectly competitive equilibrium, the wage paid to employees as a result of unionization  Figure 45.4

Figure 45.4

A. remains at W'. B. remains at W*. C. increases from W* to W'. D. decreases from W' to W*.