Real domestic interest rates would increase in a large open economy if

A) there were a temporary negative domestic supply shock.

B) the government imposed capital controls and the capital and financial account had been in deficit.

C) foreigners were more willing to save.

D) there were a temporary negative supply shock abroad in a small open economy.

A

You might also like to view...

The recognition lag is

A) the time it takes for policy makers to obtain data indicating what is happening in the economy. B) the time it takes for policy makers to be sure of what the data are signaling about the future course of the economy. C) the time it takes to pass legislation to implement a particular policy. D) the time it takes for policy makers to change policy instruments once they have decided on the new policy. E) the time it takes for the policy actually to have an impact on the economy.

Which of the following would reflect the transactions demand for money?

A. Keeping funds in your savings account because the interest rate looks relatively attractive B. Selling common stocks you own and increasing the money in your savings account because you think stock prices will fall soon C. Keeping funds in your checking account to pay your rent D. Buying a U.S. Treasury security using funds from your checking account

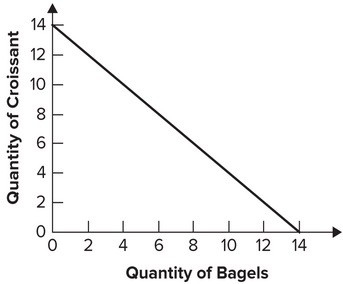

Refer to the following graph. If the price of bagels falls, the budget constraint in the graph will rotate:

A. out and become flatter. B. in and become steeper. C. in and become flatter. D. out and have the same slope.

______ occurs when the Fed buys long-term securities, thus driving down long-term interest rates and encouraging spending.

a. Quantitative speculating b. Quantitative easing c. Qualitative speculating d. Qualitative easing