The below questions relate to rate reduction bonds. Answer each one

What asset is the collateral?

What will be an ideal response?

Rate reduction bonds are backed by a special charge (tariff) included in the utility bills of utility customers in. The charge, called the competitive transition charge (or CTC), is effectively

a legislated asset. It is the result of the movement to make the electric utility industry more competitive by deregulating the industry. More details are supplied below.

Prior to deregulation, electric utilities were entitled to set utility rates so as to earn a competitive return on the assets on their balance sheet. After deregulation, the setting of utility rates to recover a competitive return was no long permissible. As a result, many electric utilities had a substantial amount of assets that they acquired prior to deregulation that would likely become uneconomic and utilities would no longer be assured that they could charge a high enough rate to recover the costs of these assets. These assets are referred to as "stranded assets" and the associated costs referred to as "stranded costs." For this reason, rate reduction bonds are also known as stranded cost bonds or stranded asset bonds. Some market participants refer to this sector of the ABS market as the "utilities" sector.

The CTC is collected by the utility over a specific period of time. Because the state legislature designates the CTC to be a statutory property right, it can be sold by a utility to an SPV and securitized. It is the legislative designation of the CTC as an asset that makes rate reduction bonds different from the typical asset securitized.

You might also like to view...

Your ________ is an essential part of your potential quality as a new hire

A) perceived ability B) salary and benefits package C) motivation D) professionalism E) reliability

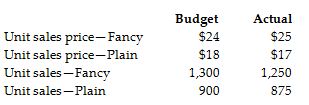

Top Half produces and sells two types of t-shirts—Fancy and Plain. The company provides the following data:

Compute the flexible budget variance for Fancy t-shirts for sales revenue.

Which of the following statements is true regarding economic events?

A) The signing of a service contract is an example of an external event that is recorded in the accounting records. B) Every event which affects an entity can be identified from a source document. C) All internal and external events must be measured with sufficient reliability. D) External events involve exchanges between an entity and another entity outside the company.

A misrepresentation is material if:

a. it would likely induce a reasonable person to enter into a transaction. b. the maker does not know it would likely induce the other party to enter into the transaction. c. it is made knowingly. d. All of these.