Mr. Johnson earns $100,000 per year. Each year he spends $70,000 and saves $30,000. He pays 5 percent sales tax on all his spending. Assuming this is only tax he pays, his average tax rate out of his income is:

a) 5.0 percent

b) 1.5 percent

c) 3.5 percent

d) 2.5 percent

Answer: c) 3.5 percent

You might also like to view...

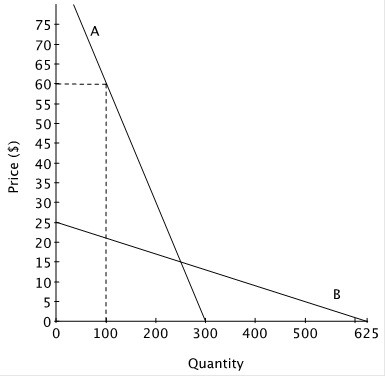

Suppose that a new drug has been approved to treat a life-threatening disease. The demand for that drug is shown on the graph below. Prior to approval of this drug, the only treatment for this condition was any one of several non-prescription, or over-the-counter, pain relievers. The demand for one brand of the several non-prescription pain relievers is also shown on the graph.  If the manufacturer of the new drug chose to increase its price from $70 to $75, consumers would buy ________ doses, and have ________ total expenditures.

If the manufacturer of the new drug chose to increase its price from $70 to $75, consumers would buy ________ doses, and have ________ total expenditures.

A. more; higher B. more; lower C. fewer; higher D. fewer; lower

A primary difference between rebates and coupons?

A) Coupons allow individuals to sort themselves into the high-elasticity group after the sale. B) Neither coupons or rebates are redeemed in high numbers. C) Rebates allow individuals to sort themselves into the high-elasticity group after the sale. D) Coupons are legal and rebates are illegal.

The greatest number of people who live on $1.90 a day live in:

A. China. B. sub-Saharan Africa. C. South Asia. D. None of these is true.

Consider an industry that is in long-run equilibrium. An increase in demand leads to no change in the price of the good. We know that this is

A. a decreasing-cost industry. B. a constant cost industry. C. an increasing-cost industry. D. not a competitive industry.