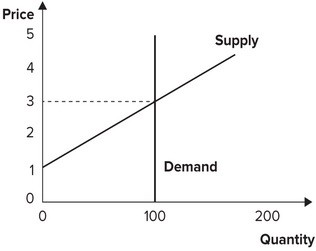

Refer to the graph shown. Initially, the market is in equilibrium with price equal to $3 and quantity equal to 100. Government imposes a tax on suppliers of $1 per unit. The effect of the tax is to:

A. give government tax revenues of $400.

B. give government tax revenues of $100.

C. reduce producer surplus by $400.

D. reduce producer surplus by $100.

Answer: B

You might also like to view...

Employing a general-equilibrium approach, describe the effect of a new law that prohibits steel imports

What will be an ideal response?

Rachel spends her income, Y, on Rock Shows (R) and Sunglasses (S) with prices pR and pS. Rachel's preferences are given by the Cobb-Douglas utility function

U(X,Y) = R.8S.2 a. Write out the Lagrangian for Rachel's utility-maximization problem. b. Use the Lagrangian to derive Rachel's optimal choice, (R*,S*). c. For a given utility level, U0, derive Rachel's Expenditure function E(pR,pS,U0). d. Use the Expenditure function to derive Rachel's compensated demand for Rock Shows.

A farmer sells sugar to a candy producer for $150 . If the producer uses this sugar to make candy that sells for $200, what is the total contribution to GDP from these transactions?

A new major league baseball expansion team is moving to your town. It will inject consumer spending worth $40 million into your local economy initially. The Chamber of Commerce predicts that this will generate a total of $500 million in additional spending for your town. The team owners think that this is an underestimate. What do you need to know to figure out who is right? Explain.

What will be an ideal response?