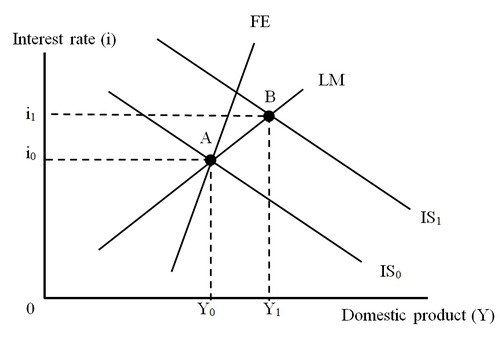

The figure below shows an IS-LM-FE model for an economy with fixed exchange rates. Initially the economy is at Point A, a triple intersection. Here, the FE curve is steeper than the LM curve. If monetary authority is unable to sterilize, output will end up

If monetary authority is unable to sterilize, output will end up

A. at Y0.

B. to the left of Y1.

C. to the right of Y1.

D. at Y1.

Answer: B

You might also like to view...

The main function of the 1997 Stability and Growth Pact (SGP) was to

A) exclude a highly indebted EMU country B) enhance cooperation between France and Germany. C) make the Euro a weak currency. D) distribute the Euro banknote among European central banks and to create a timetable for the imposition of financial penalties on countries that fail to correct situations of "excessive" deficits and debt promptly enough. E) determine specialized penalties for each member nation.

Professor's economics students are constructing models for how gasoline prices change. Maria's model has very realistic assumptions and is quite complex. Anna's model is less complicated and less realistic

Maria's model correctly predicts gas price increases 5% of the time. Anna's model predicts correctly 15% of the time. On the basis of usefulness or "goodness," Professor will give which student's model the higher grade and why? A) Maria's model gets the higher grade because it is more complex. B) Anna's model gets the higher grade because it is simpler. C) Maria's model gets the higher grade because it is more realistic. D) Anna's model gets the higher grade because it predicts accurately more often.

The purchasing power parity theory states that

A) exchange rates between any two currencies will adjust to reflect changes in the relative price level of the two countries. B) exchange rates between any two currencies will adjust to reflect change in the relative income growth rates of the two countries. C) the larger the economic growth rate in a country, the less likely its currency will depreciate in value. D) exchange rates cannot be compared over time. E) currencies appreciate as often as they depreciate.

The Federal Funds rate is

A. directly determined by the Federal Reserve. B. determined by market forces alone, without Federal Reserve influence. C. determined by market forces but targeted by the Federal Reserve. D. determined by Congress.