Under a system of freely flexible (floating) exchange rates an American trade deficit with Mexico will tend to cause

A. the United States government to ration pesos to American importers.

B. a flow of gold from the United States to Mexico.

C. an increase in the peso price of dollars.

D. an increase in the dollar price of pesos.

D. an increase in the dollar price of pesos.

You might also like to view...

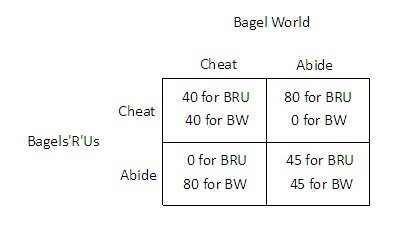

The market for bagels contains two firms: BagelWorld (BW) and Bagels'R'Us (BRU). The owners of the two firms decide to fix the price of bagels. The table below shows how each firm's profit (in dollars) depends on whether they abide by the agreement or cheat on the agreement.  Is this game a prisoner's dilemma?

Is this game a prisoner's dilemma?

A. Yes, because if both firms played their dominated strategy, they each would earn a higher payoff than when they both play their dominant strategy. B. No, because neither firm has a dominant strategy. C. Yes, because if both firms played their dominant strategy, they each would earn a higher payoff than when they both play their dominated strategy. D. No, because cheating yields the highest payoff for both firms.

A perfectly competitive firm maximizes profits? (or minimize? losses) when it produces the quantity where marginal revenue equals marginal cost and the price? is:

A. greater than average fixed cost. B. greater than average variable cost. C. greater than average total cost. D. greater than marginal cost

If real wages fall:

A) consumer demand is likely to increase. B) employers are likely to hire more workers. C) the level of economic production will always increase. D) the level of economic production will always decrease.

An economist who would most likely use active policy making would support which of the following conclusions?

A) Demand shocks have little or no short-run effects on real Gross Domestic Product (GDP) and unemployment. B) Pure competition is not typical in most markets. C) Price flexibility is common in most markets. D) Supply shocks explain most business cycles.