A man-made system consisting of people, authority, organization, policies, and procedures whose objective is to accomplish the work of planning and controlling the operations of the organization.

A. operations process

B. management process

C. information process

D. planning process

Answer: B

You might also like to view...

Which of the following is included in the strategic management process?

A. analysis of internal opportunities and threats B. employee interviews and performance reviews C. strategic review and evaluation D. analysis of external strengths and weaknesses E. SWOT analysis and strategy formulation

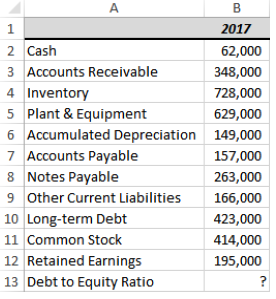

What should be the formula in B13?

a) =SUM(B7:B10)/SUM(B11:B12)

b) =SUM(B7:B10)/B11

c) =B10/SUM(B11:B12)

d) =(B3-B4)/(B2+B3-B4)

e) =B10/SUM(B11:B12)

An employee earns $5950 per month working for an employer. The FICA tax rate for Social Security is 6.2% of the first $128,400 of earnings each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7000 of an employee's pay. The employee has $200 in federal income taxes withheld. The employee has voluntary deductions for health insurance of $168 and contributes $84 to a retirement plan each month. What is the amount the employer should record as payroll taxes expense for the employee for the month of January?

A. $499.18 B. $455.18 C. $664.18 D. $812.18 E. $902.93

Allocating joint costs based upon a physical measure ignores the revenue-generating ability of individual products

Indicate whether the statement is true or false