Some economists have proposed making the tax treatment of employer-provided health insurance the same as the tax treatment of individually purchased health insurance and out-of-pocket health care spending

Such changes would make it more likely that

A) insurance deductibles would decrease.

B) employers would provide more generous medical coverage to their employees.

C) consumers would pay prices closer to the actual costs for routine medical care.

D) the quantity of medical services demanded would increase.

C

You might also like to view...

If a firm has a long-run average cost of $2 when it produces 4,000 units of an input and has a long-run average cost of $1 when it produces $10,000 units and the firm needs 10,000 units of the input, the firm ________ experience economies of scale, which makes the firm ________ likely to make the input rather than buy it.

A) does not; more B) does; less C) does; more D) does not; less

A second-price auction

a. is also called a Vickrey auction b. is where bidders submit increasing bids until all but one remains c. is where the sole remaining bidder wins and pays his winning bid d. all of the above

A farmer is deciding whether or not to add fertilizer to his or her crops. If the farmer adds 1 pound of fertilizer per acre, the value of the resulting crops rises from $80 to $100 per acre. According to marginal analysis, the farmer should add fertilizer if it costs less than:

A. $12.50 per pound. B. $20 per pound. C. $80 per pound. D. $100 per pound.

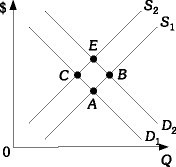

Refer to the information provided in Figure 3.16 below to answer the question(s) that follow. Figure 3.16Refer to Figure 3.16. When the economy moves from Point A to Point E, there has been

Figure 3.16Refer to Figure 3.16. When the economy moves from Point A to Point E, there has been

A. a decrease in demand and a decrease in supply. B. an increase in demand and a decrease in supply. C. an increase in quantity demanded and an increase in quantity supplied. D. an increase in demand and an increase in supply.