Explain the shell company fraud

A shell company fraud first requires that the perpetrator establish a false supplier on the books of the victim company. The fraudster then manufactures false purchase orders, receiving reports, and invoices in the name of the vendor and submits them to the accounting system, which creates the allusion of a legitimate transaction. Based on these documents, the system will set up an account payable and ultimately issue a check to the false supplier (the fraudster).

You might also like to view...

Failure to furnish a correct TIN to a requester (payer) can result in a penalty for the payee of:

A. $25 for each failure to complete a W-9. B. $50 for each failure to complete a W-9. C. $500 maximum for failure to complete any W-9 forms as required. D. $0, it is the responsibility of the payer (requester) to have the correct information.

The goal of most academic research is for the researcher to learn

Indicate whether the statement is true or false.

Sparrow Corporation The items listed below were identified while preparing a bank reconciliation for the checking account of Sparrow Corporation as of March 31, 2012. Sparrow's balance according to the general ledger ? Bank statement balance $18,500 Outstanding checks 2,700 A customer's NSF check returned by the bank 350 Bank service charges 100 Deposits in transit 1,000 Interest earned on the

checking account 60 Refer to the information presented for Sparrow Corporation. How will the outstanding checks be handled within a bank reconciliation? A) Add to the balance in the company's records B) Subtract from the balance in the company's records C) Add to the bank statement balance D) Subtract from the bank statement balance

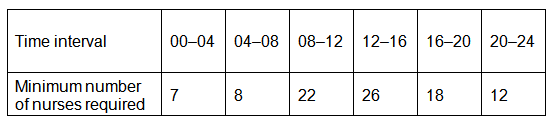

Maureen, hospital administrator for Trinity Hospital, would like to set up a work schedule for the hospital’s nurses. Each nurse will work for 8 consecutive hours. The minimum number of nurses needed in each of six 4-hour time intervals is shown in the following table. How many nurses will be required to maintain the minimum staffing levels?

a. 33

b. 29

c. 41

d. 47