Discuss the meaning of the phrase of supply-side economics, discussing how it is similar and different from the traditional classical model. Make sure to discuss the role of the Laffer curve in supply-side theory

What will be an ideal response?

Classical economists did not pay much attention to the supply-side effects of changes in income tax rates because, at that time, the marginal income tax rate was very low and pertained only to the relatively wealthy. On the other hand, Supply-side economics focuses almost exclusively on the negative supply effects of changes in tax rates. The Laffer curve says that past a certain level, higher marginal tax rates create such a large disincentive to work and investment that production would begin to significantly fall. This leads to a fall in tax revenue as marginal tax rates rise.

You might also like to view...

What's another term for "positive externality"?

A) Negative externality B) Spillover cost C) Spillover benefit D) The "pay-as-you-go" principle

When a government subsidy is granted to the sellers of a product, buyers can end up capturing some of the benefit because

a. the market price of the product will fall in response to the subsidy. b. the market price of the product will rise in response to the subsidy. c. the market price of the product will not change in response to the subsidy. d. producers will reduce the supply of the product.

In June 2009 the Bureau of Labor Statistics reported an adult population of 234.9 million, a labor force of 154 million and employment of 141.6 million. Based on these numbers the unemployment rate was

a. 93.3/234.9. b. 12.4/234.9. c. 93.3/154. d. 12.4/154.

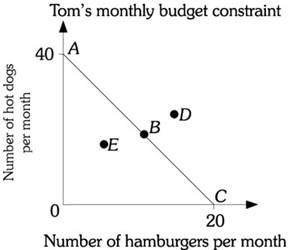

Refer to the information provided in Figure 6.1 below to answer the question(s) that follow. Figure 6.1Refer to Figure 6.1. The slope of budget constraint AC is

Figure 6.1Refer to Figure 6.1. The slope of budget constraint AC is

A. -5.0. B. -2.0. C. -0.5. D. indeterminate from this information because prices are not given.