Why does the Fed have imperfect control over the money supply?

a. Because the Fed does not know how much reserves will change when it buys or sells securities.

b. Because of unpredictable changes in the public's desire to hold cash and banks' desires to hold reserves.

c. Because of unpredictable changes in reserve requirements.

d. Because of the secrecy of FOMC meetings, which lead to policy surprises.

b

You might also like to view...

Refer to the table above. At what price does the market for notebooks clear?

A) $3 B) $4 C) $2 D) $5

A consumer chooses an optimal consumption point where the

a. marginal rate of substitution equals the relative price ratio. b. slope of the indifference curve exceeds the slope of the budget constraint. c. ratios of all the marginal utilities are equal. d. All of the above are correct.

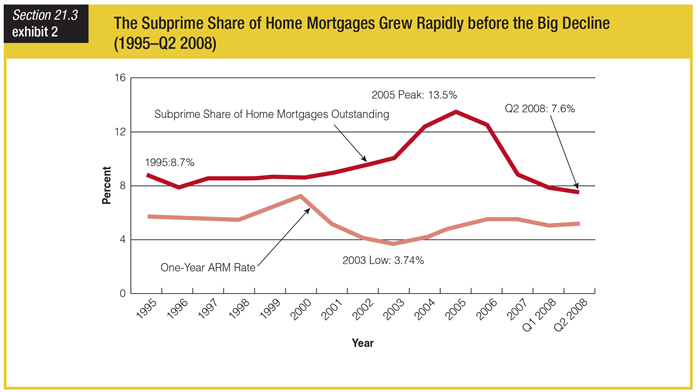

Based on the graph showing how the subprime share of home mortgages grew rapidly before the big decline, what can be determined by looking at the two years before and the two years after the period when subprime mortgages’ share of the market reached its peak?

a. The share of subprime mortgages remained near the peak the entire period.

b. The share of subprime mortgages fell at the same pace that it rose.

c. The share of subprime mortgages rose faster than it fell.

d. The share of subprime mortgages fell faster than it rose.

The demand for the Franconian franc in the foreign exchange market equals 14,000 - 3,000e and the supply of francs in the foreign exchange market equals 2,000 + 2,000e, where e is the nominal exchange rate expressed in U.S. dollars per franc. If the franc is fixed at 3 U.S. dollars per franc, then to maintain this fixed rate Franconia's international reserves must:

A. decrease by 3,000 dollars per period B. decrease by 9,000 dollars per period C. increase by 3,000 dollars per period D. increase by 9,000 dollars per period