The central idea of supply-side tax cuts is that certain types of tax cuts will increase

a. aggregate demand.

b. aggregate supply.

c. the supply of imports.

d. the supply of money.

b

You might also like to view...

If sales in an industry decline,

a. demand for additional labor also declines. b. demand for additional labor increases. c. demand for additional labor stays the same. d. the unemployment rate definitely falls.

Susan is a plant manager in charge of a factory in a relatively poor country. Even though market wages are low, she decides to raise the wages of her workers. Her decision

a. might increase profits if it means that the wage is high enough for her workers to eat a nutritious diet that makes them more productive.

b. will help eliminate the excess supply of labor.

c. may cause her workers to reduce the effort they expend at their jobs.

d. All of the above are correct.

If the total cost of production increases by 10% and output increases by less than 5%, then the firm is experiencing

A. constant returns to scale. B. decreasing average total costs. C. diseconomies of scale. D. economies of scale.

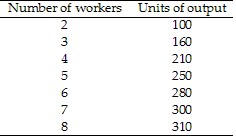

Refer to Table 10.1. Suppose that this year the wage rate is $30 and the price of the good is $1. If the firm is maximizing profit, ________ workers will be hired. Next year the wage rate will increase to $40, but the price of the good will remain at $1. Then ________ workers will be hired.

Refer to Table 10.1. Suppose that this year the wage rate is $30 and the price of the good is $1. If the firm is maximizing profit, ________ workers will be hired. Next year the wage rate will increase to $40, but the price of the good will remain at $1. Then ________ workers will be hired.

A. 6; 5 B. 6; 6 C. 7; 6 D. 5; 5