When persistent inflation is present, we would expect

a. borrowers to systematically gain at the expense of lenders.

b. lenders to systematically gain at the expense of borrowers.

c. nominal interest rates to be higher than would be true if prices were stable.

d. nominal interest rates to be lower than real interest rates.

C

You might also like to view...

What is an indifference curve?

A) It is a curve that shows the combinations of consumption bundles that give the consumer the same utility. B) It is a curve that shows the total utility and the marginal utility derived from consuming a bundle of goods. C) It is a curve that ranks a consumer's preference for various consumption bundles. D) It is a curve that shows the tradeoff a consumer faces among different combinations of consumption bundles.

The interest-rate effect is partially explained by the fact that a higher price level reduces money demand

a. True b. False Indicate whether the statement is true or false

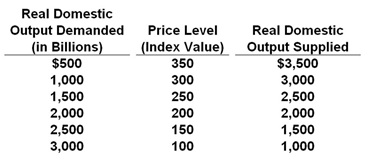

It shows the aggregate demand and aggregate supply schedule for a hypothetical economy.

Refer to the table above. If the quantity of real domestic output demanded increased by $1000 at each price level, the new equilibrium price level and quantity of real domestic output would be:

A. 150 and $2500

B. 250 and $2500

C. 200 and $2000

D. 300 and $3000

Demand is more elastic for an item for which few substitutes are available.

Answer the following statement true (T) or false (F)