Robert lost his job during the last recession and his yearly income fell by 15 percent. As a result of the action of automatic stabilizers, his disposable income would likely have fallen by less than 15 percent

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

BHP Billiton is a Canadian company that owns mines in Canada that

A) produce nickel. After World War II, BHP Billiton began to compete with another Canadian firm, the International Nickel Company. This competition eventually ended International Nickel's monopoly in this market. B) produce coal. Until World War II, BHP Billiton had a monopoly on coal in Canada. C) produce bauxite, the mineral needed to produce aluminum. BHP Billiton began to mine bauxite after World War II. This competition eventually ended the Aluminum Company of America (ALCOA)'s monopoly in this market. D) produce diamonds.

Suppose technical change permits cable television companies to provide their services at lower rates. The share-the-gains, share-the-pains theory would predict that the regulators would

A) permit the firms to keep the savings and would lower prices only if the firms were pressured to do so. B) force the firms to pass all the savings on to consumers in the form of lower prices. C) force the firms to pass the savings on to consumers in the form of better service. D) force the firms to pass some of the savings on to consumers and to permit the firms to keep some of the savings themselves.

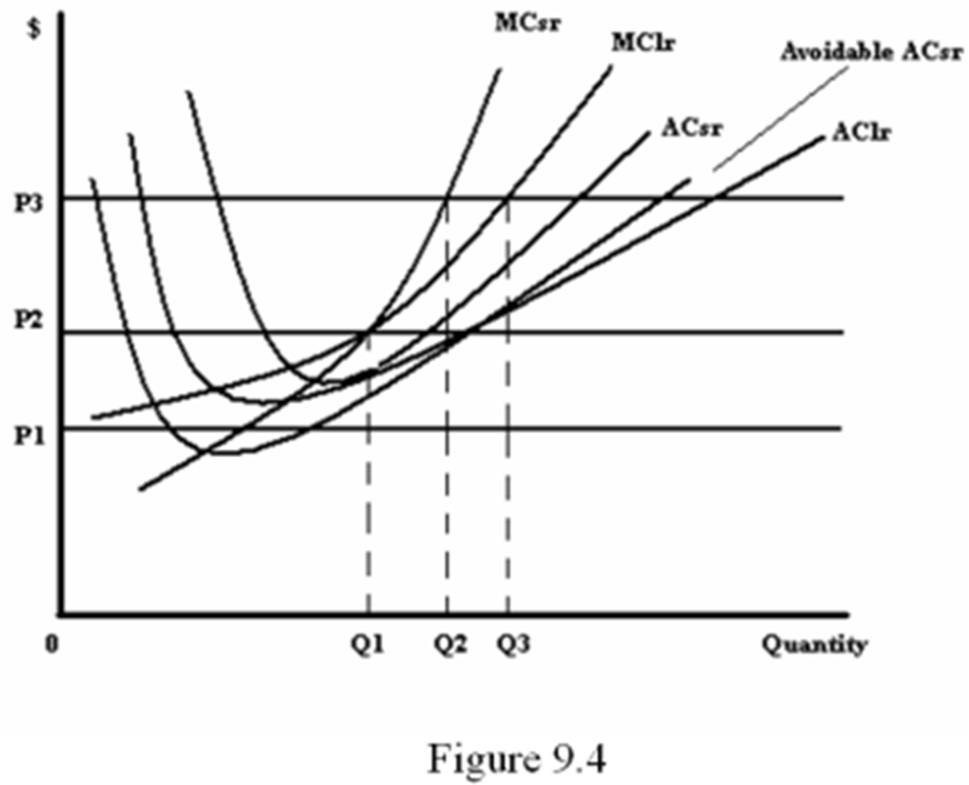

Refer to Figure 9.4. In the short run, how much should the firm produce at the price P3?

A. 0

B. Q1

C. Q2

D. Q3

If the labor supply curve is nearly vertical, a tax on labor

a. has a large deadweight loss. b. raises a small amount of tax revenue. c. has little impact on the amount of work that workers are willing to do. d. results in a large tax burden on the firms that hire labor.