Which of the following statements is true for the average individual investor interested in stocks?

a. Trying to pick the stocks that will gain a great deal in the future is a risky and unlikely way to become rich.

b. The majority of individual financial investors outguess the market better than professionals.

c. Stocks are both low risk and low return but have high liquidity.

d. Investing in stocks, bonds, or gold will (on average) provide about the same rate of return in a fiscal year.

a. Trying to pick the stocks that will gain a great deal in the future is a risky and unlikely way to become rich.

Trying to pick the stocks that will gain a great deal in the future is a risky and unlikely way to become rich. While some investment advisers are better than average in any given year, and some even succeed for a number of years in a row, the majority of financial investors do not outguess the market.

You might also like to view...

The minimum wage is an example of a government price ceiling and results in a reduction in unemployment.

Answer the following statement true (T) or false (F)

If the short-term nominal interest rate is 3.4%, the term structure effect is 1.2%, the default-risk premium is 1.4%, and the expected rate of inflation is 2.7%, the long-term real interest rate will be

A) -1.9%. B) 0.5%. C) 3.3%. D) 8.7%.

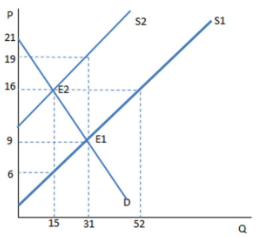

The graph shown demonstrates a tax a sellers. Before the tax was imposed, the sellers produced ________ units and received __________ for each one sold.

A. 15; $16

B. 31; $9

C. 31; $19

D. 15; $6

According to the theory of comparative advantage, a country exports goods when it can produce those goods ________ than other countries.

A. at a higher opportunity cost B. using fewer resources C. at a lower opportunity cost D. using more resources