A one-year bond has an interest rate of 5% today. Investors expect that in one year, a one year bond will have an interest rate equal to 7%

According to the expectations theory of the term structure of interest rates, in equilibrium, a two-year bond today will have an interest rate equal to A) 3.0%.

B) 5.0%.

C) 5.5%.

D) 6.0%.

D

You might also like to view...

To improve your own bargaining position

a. have low valued outside options b. increase the value of outside options c. do not alter the value of your outside options d. increase the value of your opponent's outside options

Which of the following would shift the investment demand curve rightward?

a. Lower expected rates of return on investment in capital goods b. Greater inventories of capital goods c. Higher business taxes on capital goods d. A more rapid rate of technological progress

The substitution effect indicates that a profit-seeking firm will use:

A. more of an input whose price has fallen and less of other inputs in producing a given output. B. more of all inputs if production costs fall. C. more of those inputs whose marginal productivity is the greatest. D. less of an input whose price has fallen and more of other inputs in producing a given output.

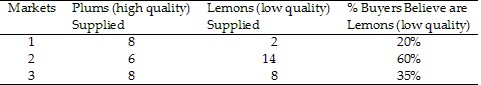

Table 14.2In Table 14.2, Market 3 would be in equilibrium if buyers believed plums account for:

Table 14.2In Table 14.2, Market 3 would be in equilibrium if buyers believed plums account for:

A. 30% of the market. B. 40% of the market. C. 50% of the market. D. 60% of the market.