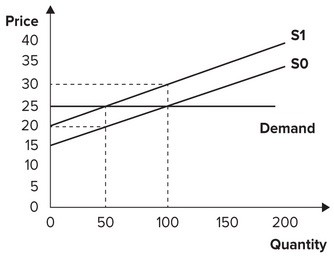

Refer to the graph shown. Initially, the market is in equilibrium with price equal to $25 and quantity equal to 100. As a result of a per-unit tax imposed by the government, the supply curve shifts from S0 to S1. The effect of the tax is to:

A. raise the price consumers pay from $25 to $30.

B. lower the price sellers keep after paying the tax from $25 to $20.

C. lower the price consumers pay from $25 to $15.

D. raise the price sellers keep after paying the tax from $25 to $30.

Answer: B

You might also like to view...

In a perfectly competitive market, the first firm to adopt a new cost-saving technological advance will

a. buy more resources b. suffer an economic loss c. earn an economic profit until other competitors adopt the technology d. export to foreign markets e. supply low income neighborhoods

Explain the economics of why the refund might be set higher than the deposit.

State officials are establishing a deposit/refund system for batteries. Marginal costs and benefits have been estimated to be: MPC = 5 + 0.5Q MPB = MSB = 20 – 0.5Q MSC = 5 + 0.7Q, whereQ is in millions, and the marginal cost and benefit values are in dollars per battery.

Briefly explain why the Social Security system will face a "crisis" in the coming years

Five hundred units of good x are currently bought and sold. The marginal buyer is willing to pay $40 for the 500th unit, and the cost to the marginal seller is $35 for the 500th unit. We know that

a. the equilibrium price of good x is somewhere between $35 and $40. b. the equilibrium quantity of good x exceeds 500 units. c. 500 units is not an efficient quantity of good x. d. All of the above are correct.