Mitzi's AGI for the year is $33,000. She is single and age 49. None of the medical costs are reimbursed by insurance. After considering the AGI floor, Mitzi's medical expense deduction is

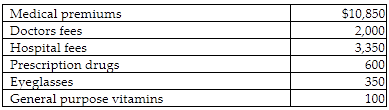

Mitzi's 2018 medical expenses include the following:

A) $12,900.

B) $13,850.

C) $14,675.

D) $16,325.

C) $14,675.

[$10,850 + $2,000 + $3,350 + $600 + $350] = $17,150 total expenses - ($33,000 × 0.075) = $14,675. The general purpose vitamins do not qualify.

You might also like to view...

Which of the following statements regarding a share repurchase is NOT true?

A) Share repurchases occur most commonly as open market repurchases. B) The firm typically buys its shares just like any investor would purchase stocks listed on a stock exchange. C) A firm often announces its intention to repurchase a certain number of its shares, say over the upcoming year. D) In most cases, a firm may agree to repurchase shares from a major shareholder at a negotiated price.

The main advantage of the Roth IRA over the traditional IRA is the employer matching funds

Indicate whether this statement is true or false.

Such heavyweight players as Microsoft, IBM, Siemens, and Cisco Systems view ________ as a protocol that can deliver real-time communications for IP-based voice, video, data, and instant messaging

A) SAP B) SIP C) PSA D) PSI

The viewer of an OLAP report can change its format. Which term implies this capability?

A) processing B) analytical C) dimension D) online