Justine is an artist. In 2003, she produced 15 paintings and sold all 15 . In 200 . she produced 14 paintings and sold 11 . In 2005, she produced 16 paintings and sold 18 . Explain how many of Justine's paintings would be counted as part of gross private domestic investment in each of these three years

Since Justine sold everything she produced in 2003, none of her paintings would be counted as part of gross

private domestic investment in that year. In 2004, her three unsold paintings would be added to gross

private domestic investment as inventory investment. In 2005, the value of the two paintings that were

produced prior to 200 . would be subtracted from gross private domestic investment as an inventory

decrease.

You might also like to view...

In terms of aggregate demand and aggregate supply, the Great Depression can be viewed as a:

a. shift to the right of the aggregate demand curve. b. shift to the left of the aggregate demand curve. c. shift to the right of the aggregate supply curve. d. shift to the left of the aggregate supply curve.

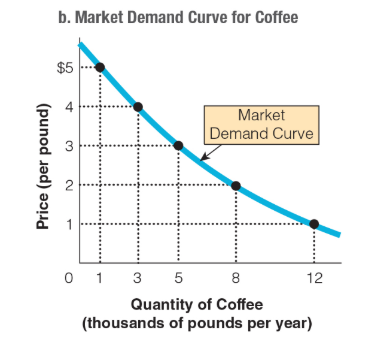

If the price of coffee is $4 per pound, how much coffee would consumers collectively be willing to purchase?

a. 3,000 pounds per year

b. 5,000 pounds per year

c. 8,000 pounds per year

d. 12,000 pounds per year

In the basic model with an AD and LRAS curve only, if spending growth is 10% and the Solow growth rate falls from 5% to 3%, then inflation will:

What will be an ideal response?

Economic takeoff:

A. occurs when development becomes self-sustaining. B. will eventually occur in all developing countries. C. typically occurs in the absence of foreign investment. D. has yet to occur in any developing country.