Assume that a no-load open-end mutual fund holds securities with a total market value of $20 million, has no liability, and has 250,000 shares outstanding. The net asset value par share of this fund is

A) $5 million.

B) $80 million.

C) $5.

D) $8.

D

You might also like to view...

Table 10-2 ? Firm A Firm B Firm C Firm D Total revenue (TR) $ 100 150 100 100 Total variable cost (TVC) 180 160 60 140 Short-run nonvariable cost 60 20 60 100 ? Refer to Table 10-2. Which firm is better off staying in business in the short run?

A. Firm A B. Firm B C. Firm C D. Firm D

Jim is haggling with a car dealer over the sale price of a used car. When he entered the store, it was empty. During the negotiations, a second customers walks in, interested in that particular car, and the storekeeper rejects Jim's offer. This is because

a. The car dealer's disagreement value decreased b. The car dealer's disagreement value increased c. The car dealer's disagreement value did not change d. None of the above

Peak efficiency _________ achieved under monopolistic competition.

Fill in the blank(s) with the appropriate word(s).

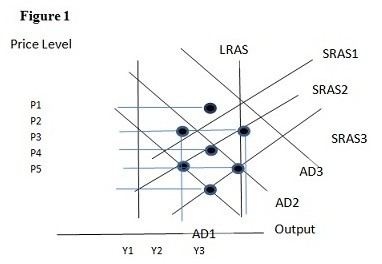

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the long run would be:

A. P1 and Y2. B. P2 and Y2. C. P3 and Y1. D. P2 and Y3.