Your client wants to avoid any penalty for underpayment of estimated taxes by making timely deposits. Determine the amount of the minimum quarterly estimated tax payments required to avoid the penalty. Assume your client's adjusted gross income last year was $140,000.

A) $7,650

B) $7,750

C) $8,750

D) $11,000

A) $7,650

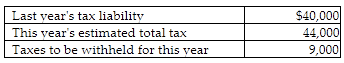

Use the lesser of 90% of this year's tax or 100% of last year's tax.

This amount is less than 25% of last year's tax liability ($40,000) minus the amount withheld ($9,000) or $7,750.

You might also like to view...

Answer the following statements true (T) or false (F)

1. Chronological transitions help the listener understand the time relationship between the first main point and the one that follows 2. Causal transitions help show the cause-and-effect relationships between the ideas. 3. You should use your extemporaneous outline the first time you practice your speech. 4. A practice speech is necessary; it acts as an oral rough draft of your presentation.

Carson Inc Carson Inc had the following information available at the end of its current year: Sales $2,000,000 Net operating income 500,000 Average operating assets 1,200,000 Refer to the Carson Inc information above. What was Carson's margin for the year?

A) 2.4% B) 41.7% C) 25.0% D) 166.7%

On September 30 of the current year, a company acquired and placed in service a machine at a cost of $700,000. It has been estimated that the machine has a service life of five years and a salvage value of $40,000. Using the double-declining-balance method of depreciation, complete the schedule below showing depreciation amounts for all six years (round answers to the nearest dollar). The company closes its books on December 31 of each year. YearDepreciation for the PeriodEnd of Period?Beginning ofPeriod BookValueDepreciationRateDepreciationExpenseAccumulatedDepreciationBookValue1?????2?????3?????4?????5?????6?????

What will be an ideal response?

If P(A) = 0.25 and P(B) = 0.65, then P(A and B) is:

a. 0.25 b. 0.40 c. 0.90 d. cannot be determined from the information given