Explain the multiple expansion process and detail a multiple expansion scenario that features at least three deposits. Be sure to provide exact numbers for each step and note the total amount of new money created from the initial deposit.

What will be an ideal response?

Answers and examples will vary but should demonstrate understanding of the multiple expansion process and how a deposit can be used to make a series of loans, each of which creates new money. One possible answer is: Bank A receives a deposit of $20,000. It has a required reserve ratio of 10 percent, leaving the bank with $18,000 in excess reserves. Bank A makes a loan with this money to Caleb, who deposits the funds into Bank B. Bank B also has a reserve ratio of 10 percent, meaning it has $16,200 in excess reserves. Bank B makes a loan to Ysenia using this money. Ysenia deposits the money into Bank C, which has a reserve ratio of 12 percent, leaving it with $14,256 in excess reserves. It loans this money to Malik, who deposits it in Bank D. The total amount of money created because of the initial deposit is $48,456.

You might also like to view...

If the income elasticity for chocolate chip cookies is 1.84, then chocolate chip cookies are

A) a normal good and income inelastic. B) a normal good and income elastic. C) an inferior good and income inelastic. D) an inferior good and income elastic.

A vertical supply curve for fish represents a

a. surplus of fish b. shortage of fish c. market-day supply curve d. short-run supply curve for fish e. long-run supply curve for fish

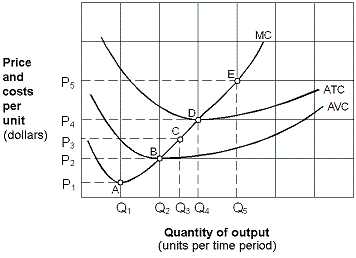

Exhibit 8-13 Price and cost per unit curves

A. produce Q3 and earn an economic profit. B. produce Q3 and incur a loss in the short run. C. produce Q3 and earn zero economic profit. D. decide not to produce any output to minimize the loss.

Which of these changes is observed in an economy when a recessionary gap is closed in the long run?

What will be an ideal response?